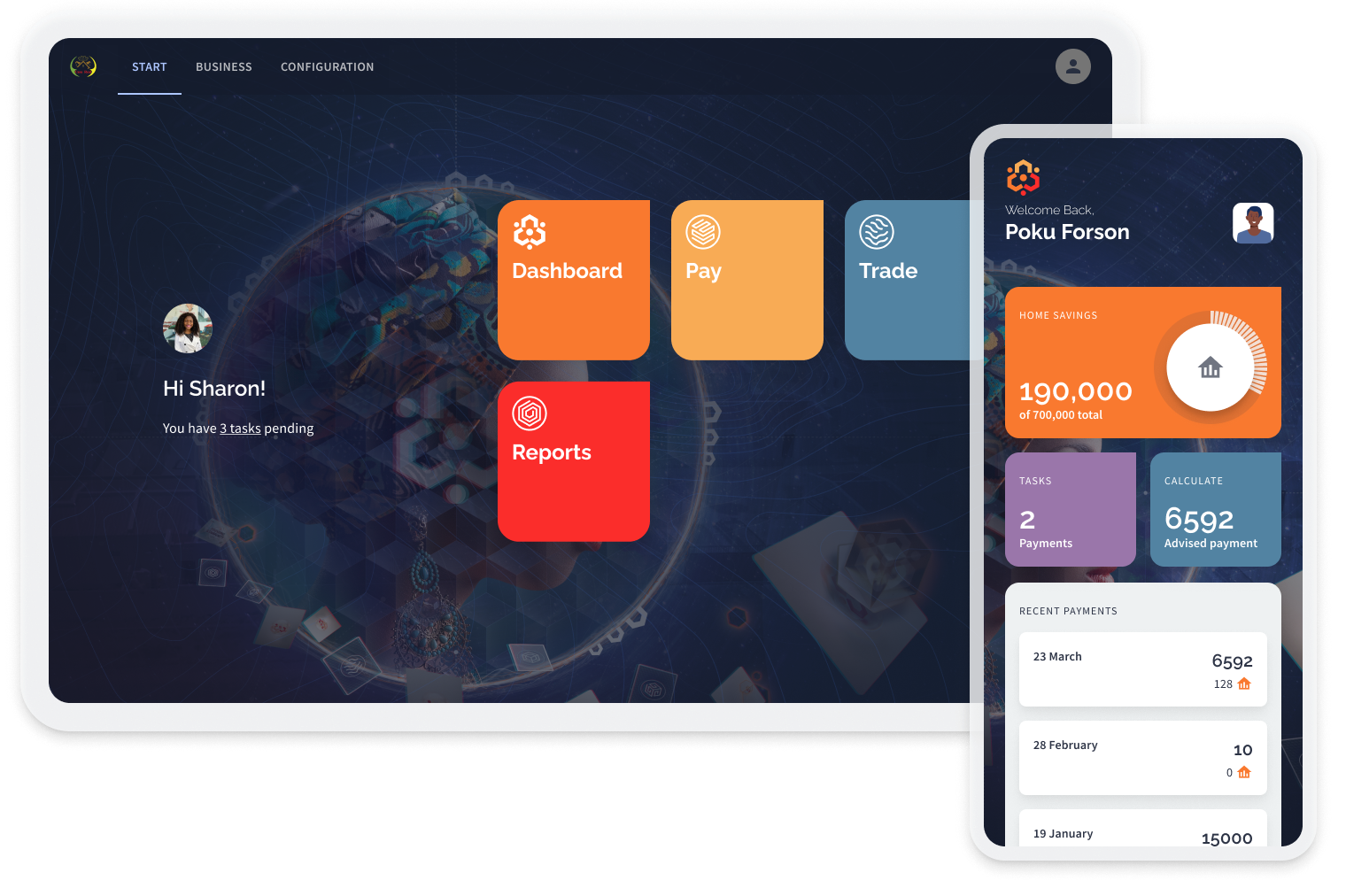

Empowa Pay is a mobile application designed for recording and tracking rent payments for Empowa-financed homes. This app is set to revolutionize the way rent-to-own payments are made, by leveraging blockchain technology to create a verified repayment history for each tenant. Through this decentralized process, Empowa will be able to better support the management of rent-to-own offerings, ensuring verified financial information, reducing risk, and reducing the cost of finance to the consumer, all without compromising on returns.

Empowa Pay is the tenant-facing interface to the Empowa Platform. With Empowa Pay, both in-country service providers and rent-to-own customers can record and track all payments, including those from formal and informal sources. The app provides a simple, easy-to-use interface that motivates customers to stay up-to-date and enables them to keep track of their rent payments, ensuring timely payments and reducing the risk of missed payments.

By leveraging the power of Cardano blockchain technology, Empowa Pay creates a secure, tamper-proof record of all rent payments. This record builds a repayment history for each rent-to-owner and a credit history for each customer.

It is important to note that the recording and verification of rent-to-own payments is for information purposes as the loan is made to the in-country service provider responsible for the administration of the loan. The local partner is far better suited to assessing and managing risk through their knowledge of, and relationships with, the rent-to-own tenants on the ground.

This is one of the significant strengths of the Empowa model because while the developer is responsible for the repayment of the loan, the risk is diversified across many different families through the rent-to-own model.

Empowa Pay is critical to the support of the lease-to-own home loan model as it requires a technology platform that supports the financial principles of the product. Under lease-to-own monthly rent payments are differentiated from equity payments. Monthly rental payments do not contribute to the equity component of the home. Rather they represent the tenant’s monthly cost of living in the house. Tenants can then contribute to the equity (capital portion) of their home as and when they can, based on the intermittent sources of income prevalent in the informal environment. These payments ultimately pay down the cost of the house allowing the lease-to-own tenant to become a homeowner. To read more about the difference between rent and equity payments and how lease-to-own home loans work click here.

As long as a tenant is paying their monthly rent, and contributing periodically to the equity portion of their home, they may remain in the house. This ensures that the intermittent nature of income from informal sources is not used to disqualify the vast majority of the African working population from owning a home. Empowa Pay will enable the service provider to record these payments and through multi-party verification will create an on-chain record of such lease payments, and then provide timeous, verified financial information to investors as to the performance of their investment.

To read more about our traffic light system for scoring loans click here.

Empowa Pay is one part of the Empowa Platform revolutionizing the affordable and climate-smart home finance market in Africa. Empowa Pay enables local service providers to offer a lease-to-own solution for affordable, climate-smart housing increasing home ownership possibilities to more than 80% of the working population previously excluded due to informality.

Empowa Pay is doing even more than improving living conditions and enabling wealth creation, it’s also significantly improving financial inclusion as it creates credit histories from one of life’s fundamental expenses – housing.